|

Sellers:

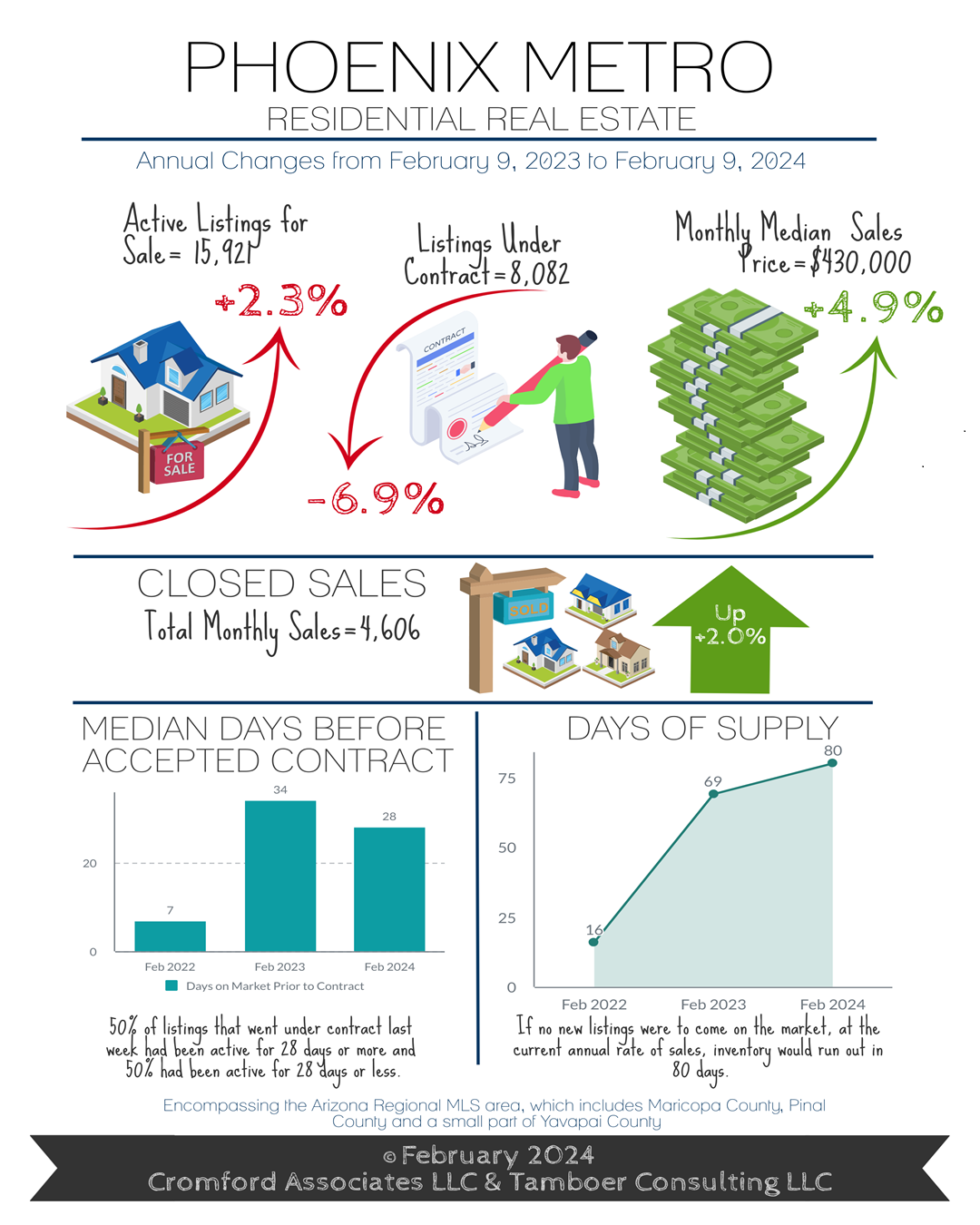

So, what’s to be expected this year? There is one market that can be affected by an election, and that’s the stock market. After the last 4 elections, the stock market has responded positively afterwards, which affects both luxury buyers and retirees with a high percentage of cash purchases. If a cash buyer expects their investment portfolio to be worth more after an election, they may simply put off their home purchase until the Spring. This can cause contract activity to stagnate for a couple months, but not enough to affect prices, and this mild affect can be offset by other mitigating factors, like seasonality, that would make the impact unnoticeable. So far in 2024, listings under contract over $1M are higher than 2022, which is the #1 record year for this price range. Active listings over $1M are also at record highs, which is offsetting the increased demand and keeping price appreciation stable. Retirement communities are not experiencing the same however, as this segment is highly sensitive to inflation. When prices for necessities are high and uncertain, many buyers in this segment will choose to keep their cash for safekeeping. Buyers: With many existing homeowners comfortably staying put these days, more attention is placed on first-time home buyers, affordability, and supply of homes. The first thing that comes to mind is the choice between renting and buying. According to RealData the median cost of a 3-bedroom apartment at a 50+ unit complex in Q2 2023 was $2,100 per month in Maricopa County. The median size is roughly 1,250 square feet. The past 30 days of sales show the median sale price of a 1,200-1,500 square foot, 3+ bedroom single family starter home to be $370,000 in Greater Phoenix. Many first-time home buyers put down 3.5% on a FHA loan ($13,000 on $370K), and last month nearly 70% in this price range had a seller or builder agree to contribute to closing costs with a rate buydown. That’s a median contribution of $10,000 from the sellers. On February 1st, the average FHA rate was 6.0% according to Mortgage News Daily. With a 2/1 buydown from the seller, the first year estimated payment would be $2,159 per month, including taxes, insurance, and PMI. A permanent 1% buydown would equate to $2,375 per month. This puts the monthly cost to buy a small starter home within a few hundred dollars of the median rental rate. Condensed Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2024 Cromford Associates LLC and Tamboer Consulting LLC

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorDonald Keys has been selling homes full-time since 2006. Archives

June 2024

Categories |

RSS Feed

RSS Feed