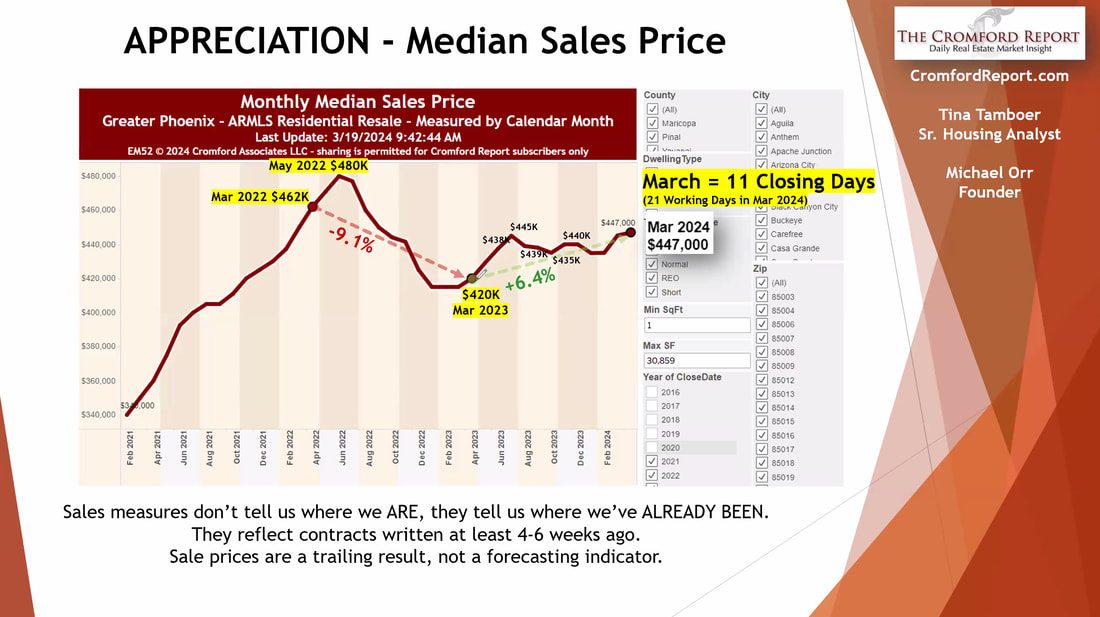

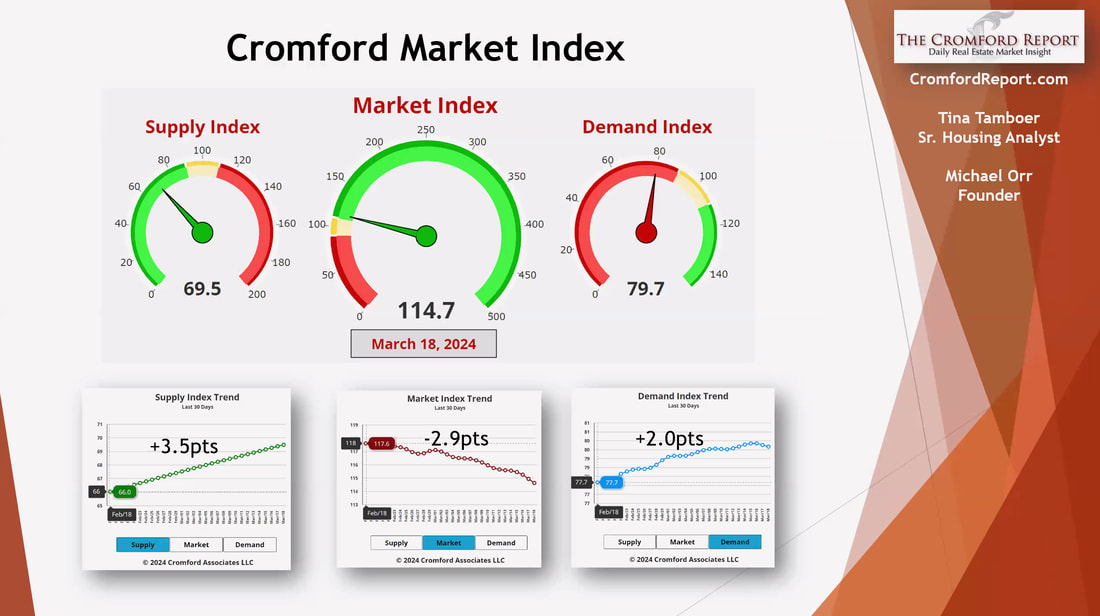

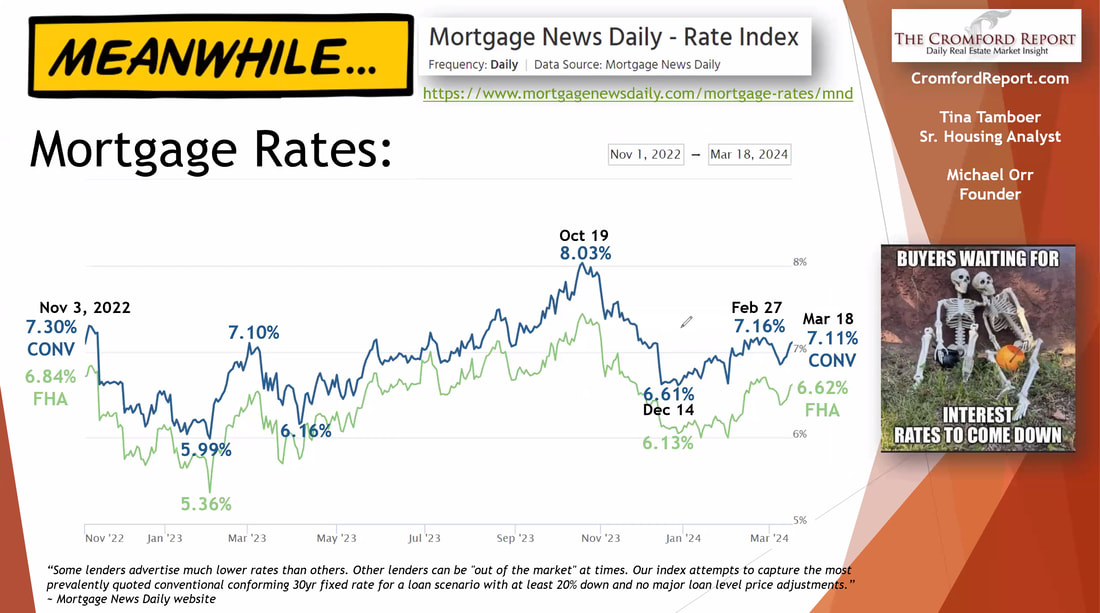

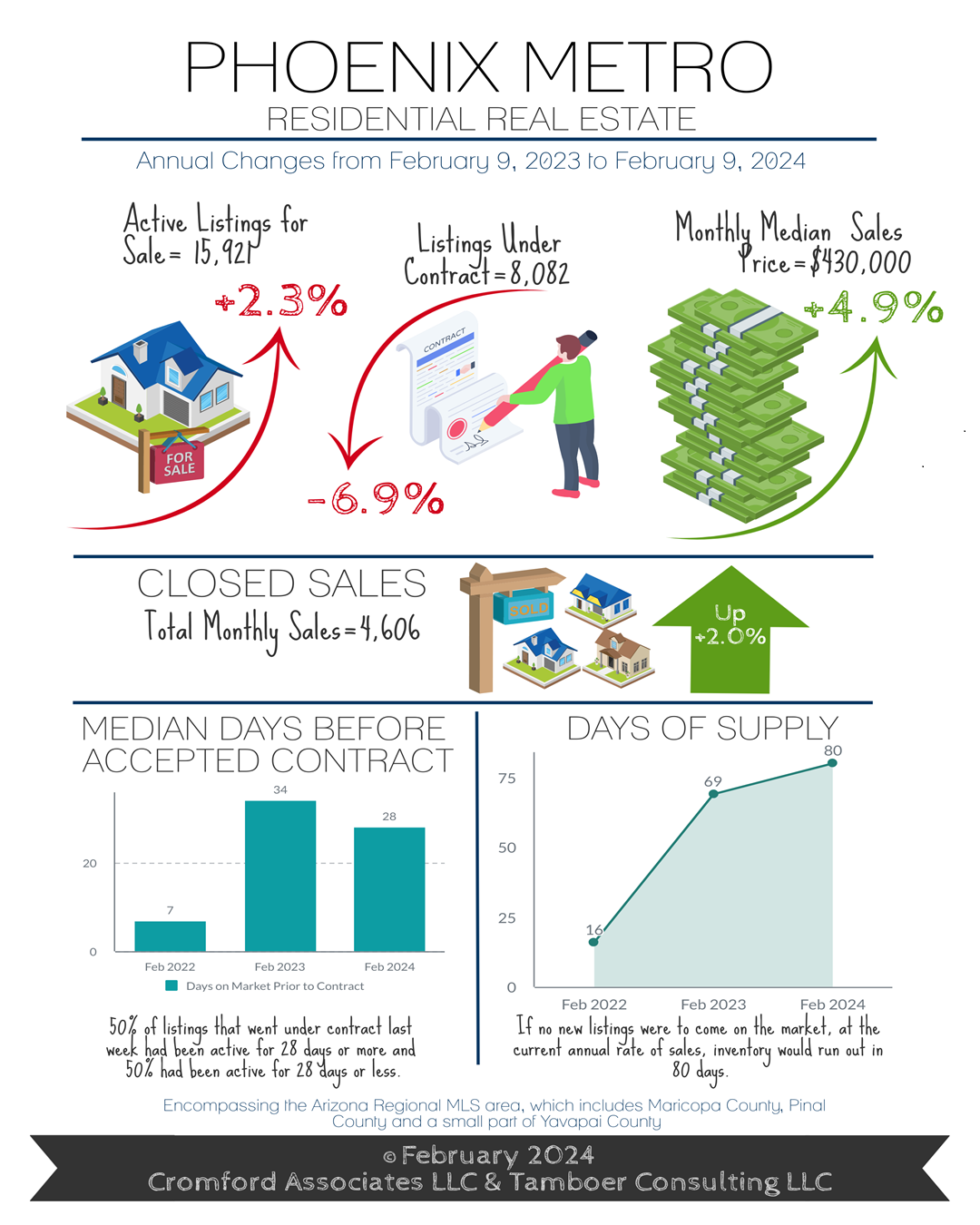

Home Price Up 6.4%!Recently I received a housing update and wanted to share some of the information with you. Home prices in the Phoenix Metro Area are up 6.4% over the last year. In March of 2023 the Median Sale Price was $420,000 and today it is $447,000 a healthy increase. Home prices are expected to continue to increase in 2024 and a projected 13% increase in the number of homes for and new home builders continue to expand their inventory and offer sales back incentives to Buyers. If you have heard the "Home prices are crashing, there is going to be a glut of homes for sale and you better wait to buy..." you may have heard chicken little telling you the sky is falling. The truth is inventory and demand are almost balanced right now and the demand side is increasing as we go into our Spring Selling Season. Looking at the Cromford Market Index, which increased to 114.7 on March 18, 2024 we are in the green and rising. What About Mortgage Rates?Taking a look at mortgage rates, we peaked on October 19, 2023 with a rate of 8.03% and saw a recently low in January 2024 of 6.14%. Since then interest rates have increased to over 7.1% and are expected to remain in the 6.75% to 7.75% for 2024. So if you are waiting for interest rates to come down before you buy a home, that could be a big mistake as home prices are increasing. As interest rates continue to normalize, more homes are being built and more Buyers and Sellers will be on the move, it is best to get your financial house in order now and make a move sooner vs later then there will be more uncertainty and competition. Is NOW The Time To Move? What if I wait?I am often asked "Is now the time to move, should I wait"? And I have always had the same answer and advice: Move when the time is right for you, if you need more space, want to be closer to family, love your interest rate but hate your home or neighborhood, have a new family member, or any other need, then by all means move. Don't wait for lower home price, lower interest rates or the perfect scenario because you will miss the opportunity of a lifetime to improve your life. The sooner you move, the better you will improve your situation. Everything in life evens out. When we purchased our most recent home, even as an Professional Real Estate Agent I was saying to myself "Wow, this home price is really high, I used to be able to get a huge home, a mansion really, in a great neighborhood in Phoenix, for the price of this modest 1,800 sq ft home and now all I get is this?" But looking back just a few years, it was one of the best decision our family made. And comparing to what we would pay for rentt, I look at our mortgage payment and smile. Our neighborhood is great, our neighbors are friendly and our children were able to attend one of the best schools in the area. On top of that our home price has increased, our mortgage balance has decreased , our net worth is higher and our family is happier. So don't wait to move.... just move when the time is right for you!

If you or anyone you know has a real estate need (Buying or Selling) call or text me with their name and number. I promise to take good care of them and love your referrals. DONALD KEYS Selling Homes Since 2006 HomeSmart (602) 750-1744 Information courtesy of Arizona's leading authority on the housing market: The Cromford Report.

0 Comments

Sellers:

So, what’s to be expected this year? There is one market that can be affected by an election, and that’s the stock market. After the last 4 elections, the stock market has responded positively afterwards, which affects both luxury buyers and retirees with a high percentage of cash purchases. If a cash buyer expects their investment portfolio to be worth more after an election, they may simply put off their home purchase until the Spring. This can cause contract activity to stagnate for a couple months, but not enough to affect prices, and this mild affect can be offset by other mitigating factors, like seasonality, that would make the impact unnoticeable. So far in 2024, listings under contract over $1M are higher than 2022, which is the #1 record year for this price range. Active listings over $1M are also at record highs, which is offsetting the increased demand and keeping price appreciation stable. Retirement communities are not experiencing the same however, as this segment is highly sensitive to inflation. When prices for necessities are high and uncertain, many buyers in this segment will choose to keep their cash for safekeeping. Buyers: With many existing homeowners comfortably staying put these days, more attention is placed on first-time home buyers, affordability, and supply of homes. The first thing that comes to mind is the choice between renting and buying. According to RealData the median cost of a 3-bedroom apartment at a 50+ unit complex in Q2 2023 was $2,100 per month in Maricopa County. The median size is roughly 1,250 square feet. The past 30 days of sales show the median sale price of a 1,200-1,500 square foot, 3+ bedroom single family starter home to be $370,000 in Greater Phoenix. Many first-time home buyers put down 3.5% on a FHA loan ($13,000 on $370K), and last month nearly 70% in this price range had a seller or builder agree to contribute to closing costs with a rate buydown. That’s a median contribution of $10,000 from the sellers. On February 1st, the average FHA rate was 6.0% according to Mortgage News Daily. With a 2/1 buydown from the seller, the first year estimated payment would be $2,159 per month, including taxes, insurance, and PMI. A permanent 1% buydown would equate to $2,375 per month. This puts the monthly cost to buy a small starter home within a few hundred dollars of the median rental rate. Condensed Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2024 Cromford Associates LLC and Tamboer Consulting LLC |

AuthorDonald Keys has been selling homes full-time since 2006. Archives

June 2024

Categories |

RSS Feed

RSS Feed