|

For Buyers:

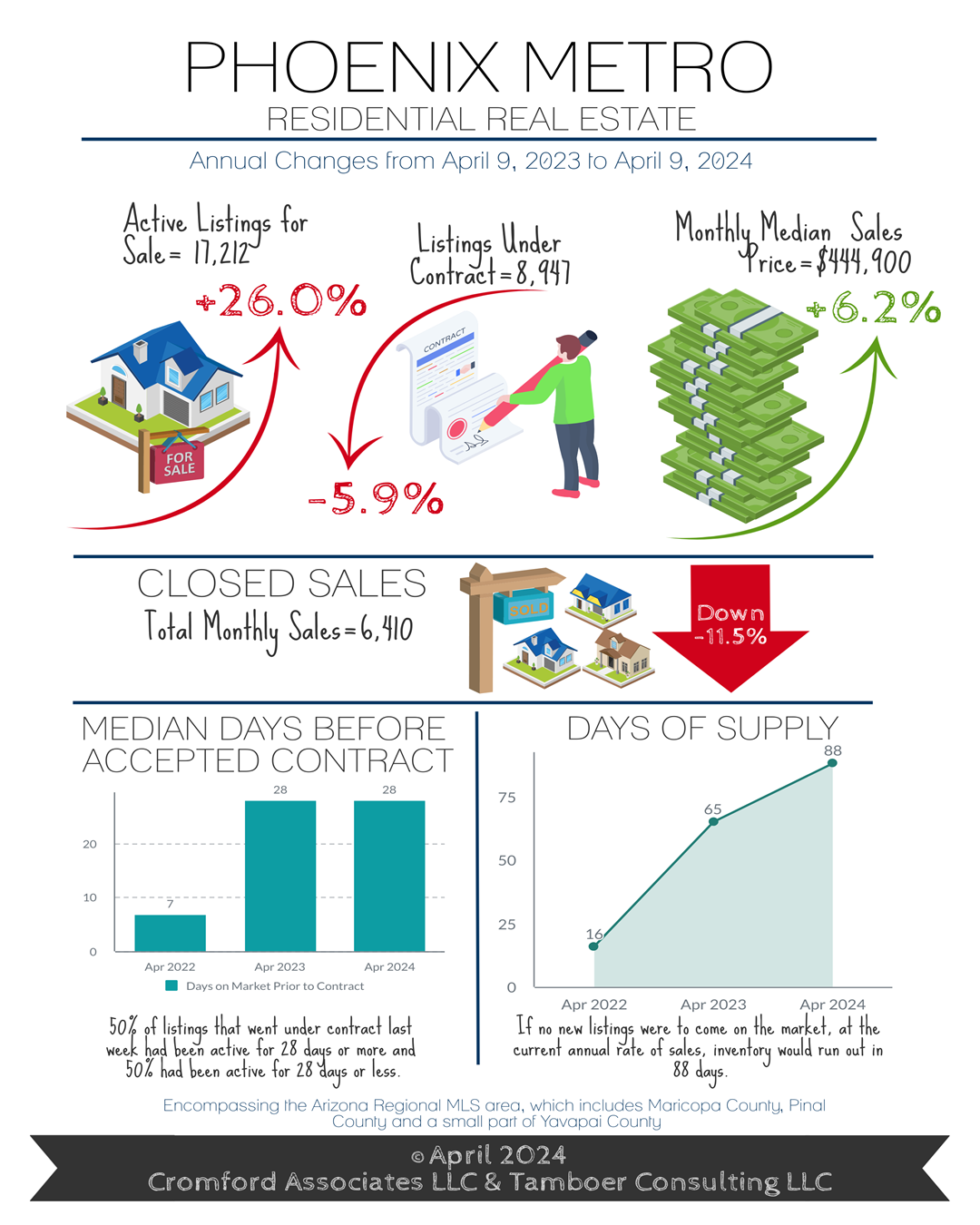

Inflation is a hot topic today. Talk to any investor about hedging inflation and they may bring up strategies that include gold, commodities, rentals, or even cryptocurrency. For young adults, however, the first step towards hedging inflation is typically moving out of a rental and into homeownership. Let’s discuss why. The Consumer Price Index (CPI) is arguably the most quoted inflation measure in mainstream media. Most readers assume the main driving forces of the CPI are food and energy. They make up 20% of the weight, so that’s a fair assumption. However, it’s shelter costs that are weighted the heaviest of all the categories at 36%, specifically the cost to rent. Nowhere in the CPI does the cost to purchase a home come into the equation because there is no rent to pay if it’s purchased with cash, or the cost is fixed for 30yrs if there’s a mortgage. So, while the Consumer Price Index has increased 12% since June 2022, once shelter is removed the increase is only 2.1%. One could argue that this is the 2-year inflation rate for those who own their primary residence versus rent, which accounts for roughly 64% of all households in Maricopa County. For Sellers: It’s the peak Spring buying season in Greater Phoenix, although it may not feel like it for some sellers. The housing market has begun to drift towards another balanced state over the past 4 weeks, which is the result of an accumulation of supply as demand remains weak. Listings under contract are only down 6% compared to last year, but active listings are up 26%. Days prior to an accepted contract would be 3 weeks at this time of year normally, but current conditions are adding an extra week for sellers. Word on the street is resale homes needing to be remodeled or updated are sitting a bit longer as builders are ramping up permits for new homes. In fact, single family permit activity is up 125% year over year for January and February and sales are up 16%, surpassing 2021 (the previous 10-year high mark). The competition isn’t just for the sub $500K market either. Luxury new home sales over $3M are up 79% so far this year and up 28% between $1M-$3M. The struggle for resale listings that need paint, carpet, or significant changes is fewer traditional buyers have the capacity to finance a remodeling project with current rates, or they may not be able to visualize the space any other way, or they may think the cost and time for basic renovations is greater than it is. As far as investor purchases go, wholesale offers are due to get uglier with increased holding costs, stagnate monthly appreciation, and smaller returns. Flip sales are down 74% from 2 years ago and at a level comparable to 2015. Whether it’s getting quotes for work, renditions to help with visualization, or advising the seller on the most important updates to make prior to listing, it’s markets like this where professional representation and feedback make a difference for both sellers and buyers. Despite current challenges, sellers are averaging 97.8% of their last list price at close of escrow so far this month. Seller-paid closing-cost assistance is down 2% to 44% of sales, and the median sales price increased to $444,900, up 6% from last year. Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2024 Cromford Associates LLC and Tamboer Consulting LLC

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorDonald Keys has been selling homes full-time since 2006. Archives

June 2024

Categories |

RSS Feed

RSS Feed